- 2023-06-13

Great Lakes and Nelnet: Part of the Same Family

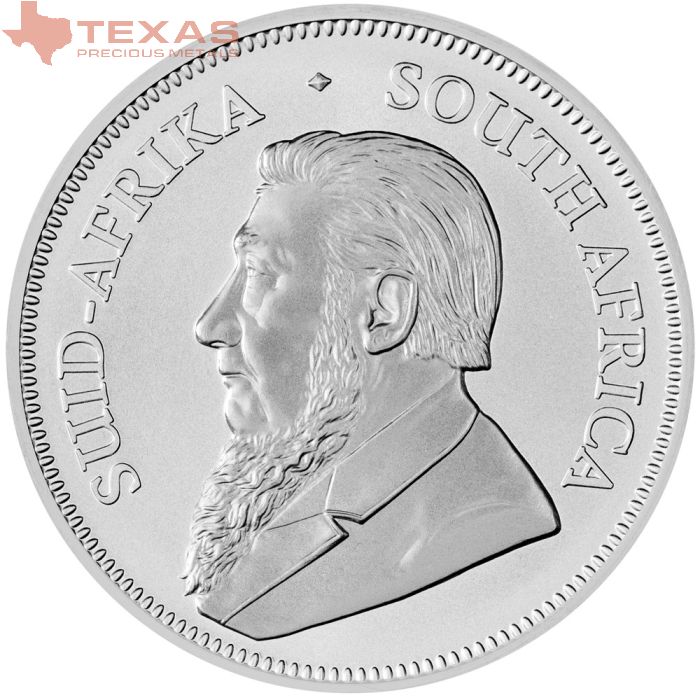

With a gold and silver IRA, investors can benefit from the potential of these metals to appreciate in value, while also protecting their savings from inflation and other market risks. The role of such company involves the following. All Gold IRA entities charge fees, although these fees will be different for each company. Their customer service is exemplary, providing prompt and helpful responses to any questions. Secure Your Retirement with GoldCo’s Trusted Gold IRA Services Get Started Now. IRA silver investments are considered a safe haven asset and a store of value, as silver tends to hold its value over time. Your custodian will issue a bank wire payment to us on your behalf, and we will ship your precious metals to your depository. Consider Lear Capital for Professional Guidance and Investment Options.

Gold and Silver IRA

Also, consider consulting your accountant or financial advisor before making any investment to ensure it aligns with your portfolio plan. A good company offers above average customer service. I am extremely satisfied with the service provided by Goldco. Your custodian will issue payment for the metals on behalf of your IRA and we’ll ship the metals to the depository you have chosen for safe storage. When you pick the custodian for your precious metals IRA, the process may be challenging. Orion Metal Exchange is your one stop shop for all your metal recycling needs. Q: What is a gold and silver IRA account.

Investor Resources

Birch Gold Group works with Depository to set up a storage plan for your metals when you open an IRA account with them. The account holder will pay an annual fee to maintain the account, and may also need to pay additional fees for storage and insurance. You must search for credibility through affiliation with industry bodies and watchdogs. In addition to the cost of the metals themselves, you’ll need to budget for other fees related to establishing and maintaining a gold IRA. The ratings are compiled by independent financial experts who provide unbiased reviews to ensure that investors have the necessary information to make informed decisions. Who is Goldco a Best https://www.outlookindia.com Match For. In fact, we would recommend this company to first time buyers because of the limitless resources and education material it offers on gold and other precious metals. Platinum and palladium IRAs are also excellent options, as their scarcity and high industrial demand give both metals significant potential for growth. A confirmation email will be sent to you once we are able to confirm the metals were received and deposited in your depository account. A transfer can be direct, meaning it is sent directly from one custodian to another or indirect meaning that the funds are sent from a custodian to the account holder. You’ll need to contact your custodian and provide them with a written request detailing the amount of funds to be withdrawn. With extensive knowledge in gold, silver, platinum, and palladium bullion, this gold IRA investments company is one of the go to companies for anyone wanting to conduct a gold IRA transfer. Investing in a gold IRA can be quite more complicated than investing in a traditional IRA.

Spotlight: What are our customers saying?

This means that they guarantee they will offer you the highest going rate for your precious metals. Overall, investing in a gold IRA can be a wise choice for those looking to diversify their retirement portfolio. Goldco is known for treating all its customers with its “white glove service” from the start. You understand, acknowledge and accept that there is a price differential or “spread” between First Fidelity’s selling price the “ask price” and First Fidelity’s buyback price the “bid price” for coins First Fidelity needs. In order to ensure that the depository meets these requirements, we guide our clients to those who meet the parameters set forth. They may tell you they have several letters from attorneys they’ve paid which declare the scheme is perfectly legal. The gold needs to be moved and stored in an IRS approved storage facility. Discover Opulence With GoldCo: Redefine Your Wealth And Success. Precious Metals IRAs are becoming a popular investment option as they facilitate retirement account diversification.

Need Help?

Investors are starting to pay attention to that fact. The pitch is for you to establish an LLC company to store the metals on behalf of your IRA in your home or nearby. As the IRA account owner, you are responsible for choosing the precious metals dealer, selecting the investment and negotiating the purchase. Good money has significant worth in its small, portable package. Read More of the post 175899Homebridge. It is essential to understand that the IRS has strict guidelines for the purity and quality of the silver that can be held in a precious metals IRA.

9 Birch Gold Group: Best For Education Resources

“Silvr is a long term partner for us, helping us through the various stages of our development. By working with an experienced IRA custodian for gold, you can make informed decisions about your investment strategy and build a diversified portfolio that aligns with your long term financial objectives. We are involved with all major refiners and many of the world’s major mints. Please see the CFTC Notice on Precious Metal Schemes. When it comes to investing in precious metals, a silver IRA is often the first choice for many investors. PAMP Swiss gold bar SN35427681. Access to exclusive content covering the latest trends in real estate digital marketing. HCF Silver Plus, $128 per month. Don’t fund a gold IRA with cash, as this causes you to lose out on the cash advantages of IRA investment. Their commitment to customer service and satisfaction is unparalleled, and they are always willing to go the extra mile to ensure that their customers are getting the best possible experience. Gold IRA custodians can provide a variety of services to help investors manage their gold investments. There are a number of factors to consider when choosing a broker or custodian, such as their fees, reputation, and customer service. Wondering if it’s still possible to arrange a payment agreement with the IRS before the 2023 tax deadline.

8 Patriot Gold Group: Good for 401k and IRA Rollovers

It is also important to ensure that the company is legitimate and compliant with IRS regulations. So, it’s important to consult with a financial professional who specializes in precious metals to understand the potential pitfalls before applying this strategy. You can include a combination of gold, silver, platinum, and palladium precious metals. Gold and silver have historically been a hedge against inflation and economic uncertainty, making them a valuable addition to any retirement portfolio. They ensure every one of their customers are well versed on gold and silver and the happenings of the financial market as a whole. If you want to open a precious metals IRA, follow the steps below. 9990 pure, and both platinum and palladium must be. All gold and silver assets are fully insured during shipping and storage. We work directly with your precious metals custodian to rollover assets from your 401k or IRA to your Noble Gold account. Few educational resources about gold or precious metal IRAs. James and the entire team at New Silver were amazingly helpful. To meet IRS’s regulatory standards, precious metal assets, in the form of bars or coins, should be held by an IRA trustee and not the IRA owner.

100 oz Englehard Silver Bar

The fee covers the costs of storage, custodian management, and quarterly statements. With the help of a gold IRA custodian, investors can easily add gold to their retirement portfolio. Goldco: Best for 401k/IRA Rollovers, Best Customer Service. Their team of experts are highly knowledgeable and experienced in the silver IRA market, providing clients with the best possible service. Gold Australian Kangaroo 99. This is crucial in the gold IRA market, where many scammers are trying to exploit investors. It’s not tied to the stock market or the housing market, so regardless of what happens in the world you know that you are protected. Researching the best Silver IRA providers for 2023 can help you make an informed decision and find a provider that meets your needs. Each customer gets a personal representative to provide assistance with self directed IRA setup and gold IRA rollovers.

Disclosures

Additionally, silver has a wide range of industrial uses, which can drive demand and potentially increase its value over time. Since its launch in 2012, Augusta Precious Metals has gained a reputation for excellent customer service and ongoing education. Qantas NIB Silver Plus Advanced, $233 per month. Just call us and ask for one of our Precious Metals IRA specialists. If you hold it for less than a year, then the sale profit will be subjected to income tax. The allowable exceptions were broadened by the Taxpayer Relief Act of 1997, effective January 1, 1998. Opening an account with a reputable gold IRA company allows you to diversify your portfolio and hold this asset. SEP stands for Simplified Employee Pension, an account mainly for self employed individuals, small business owners, and freelancers. At Ralphs Shopping Center on Friars Road, 1 block east of the 163, near Wells Fargo. Goldco does not charge any storage fees for cash transactions over $25,000.

Silver

Patriot Gold Club is an excellent gold IRA custodian Their expertise in gold investment is unparalleled, offering customers a secure and reliable platform for gold investments. In many cases, these investors have little or no say in the investments being made. Discover the Benefits of GoldCo: Invest in Your Future Today. However, they’re not immensely expensive either. RC Bullion’s commitment to excellence and customer satisfaction makes it an ideal choice for those looking to invest in a silver IRA. The IRS has strict requirements for storing IRA gold.

Contact

In addition, their website is user friendly and provides a wealth of information about silver IRA investments. These ratings show Goldco’s commitment to providing a positive customer experience and allowing customers to trust them with their financial future. Unlock the Benefits of Gold Alliance Now. As mentioned above, Advantage Gold has not been in business as long as the other companies on this list. The precious metals are among those options. Their commitment to providing quality service and their dedication to helping customers make the best decisions when it comes to investing in silver IRAs is unparalleled. As you can see not all precious metals products are approved for an IRA. Gold, first and foremost, is wealth insurance. 995 fine gold or bars that are. Check out GoldBroker for the best selection of gold bars and coins. Real Reviews from Augusta Precious Metals Clients.

PROS

It is a means of financial exchange. Unlock Your Potential with Gold Alliance. Invest in Gold with Confidence: Try GoldBroker Today. However, setting up your own precious metals IRA can be daunting, as it needs to be done correctly in order to avoid penalties by the IRS. Technically, Goldco is a broker, not a custodian. When it was time to select various quantities of metals, they spent time with me on the phone to provide recommendations and options based on my particular goals. I am extremely satisfied with the service provided by Goldco. You may name your church or any charity as the beneficiary of your IRA and its assets. Goldco maintains an in depth blog that covers a range of interesting topics in addition to the comprehensive list of videos and several e Books. Like any investment, the best gold IRA companies come with their own set of pros and cons. Or read our full Goldco Review. Birch Gold Group is a physical precious metals dealer that has been in business since 2003. Your silver holdings are not subject to income taxes until you take a distribution from your account.

BUY PRECIOUS METALS

This has made them a convenient option clients can invest in because their value stands the test of time. Unless the IRS gives written approval before the IRA is set up, it will regard the assets as income subject to immediate taxation, plus 10% additional penalty for those under 59 1/2. You will only be charged a payment when you buy or sell gold; even then, their prices are very competitive. Here we will outline some of the potential costs. More importantly, the investor cannot take the gold home. Once the account has been opened, investors will need to fill out the necessary paperwork and forms. You’ll also benefit from the convenience of being able to invest online without having to leave home or visit a physical location. For example, you could have one IRA that is invested in precious metal bullion, and another IRA that’s invested in liquid assets, such as publicly traded stocks and mutual funds. => Visit Augusta Precious Metals Website. An IRA or individual retirement account can hold a variety of assets, including precious metals such as silver.

Silver Mexican Libertad

Experience Gold Investing with GoldBroker: Secure Your Future Now. Compared to Goldco 2 on our list, Augusta is best for a high touch customer experience and high networth individuals, however, with a high investment minimum of $50K, Goldco is much more accessible to most investors. They then test the metal and manufacture their branded products which they sell to authorized dealers. Self directed IRAs have many types and come with different tax benefits and advantages. Many factors were considered, such as the company’s length of time in business, complaint history, transparency, and more. Partnering with Reputable Companies. Reap The Benefits Of Investing With American Hartford Gold Group. Joe Montana is a customer and paid ambassador for Augusta. Which Metals Are Best for My IRA.

ReadLocal

The company has a reliable team of experts that provide comprehensive services and guidance to their clients. ” Here are five red flags to look for and tips on what to do instead. Avoid common and costly mistakes when investing in Precious Metals by reading this free guide. However, they’re not immensely expensive either. Depositories are highly secure storage facilities for precious metals. He even followed up with an e mail and a phone call. While all of these companies provide gold and silver IRA services, it’s essential to research each one thoroughly to find the right fit. When I made my initial call I received kind and courteous response from the first person that I talked to. You shouldn’t feel like the rep is pressuring you. Augusta Precious Metals is highly rated due to their outstanding and reliable services. They also allow clients to open either a silver or a gold IRA account. Gold IRAs are a specific type of self directed IRA that allows you to invest in physical gold and other precious metals like silver, platinum and palladium. To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met.

OmdömesStalle

American Hartford Gold has an extensive investor education program. Though these fall under the category of “alternative assets”, and might be suitable for some depending on their financial needs. Submit a request to Equity Trust to initiate your purchase – your precious metals dealer can help with this. There is no substitute for holding physical precious metals in your IRA. Why we like Goldco:Goldco has one of the best buyback guarantee programs. Let’s discuss your options and answer your questions. He has a wealth of knowledge and experience in the area, and he is passionate about helping people get the best possible deal on their loans. Clients will probably wonder where professionals are getting their money from, and rightly so. The company also maintains prolific social media accounts and a podcast that offers insights into the growth cycles of precious metals and the precious metals market. Once you’ve found a dealer, you can look at the products that are available for purchase. Precious metals and rare coins are speculative purchases and involve substantial risks. To fund your IRA, the money is then rolled over from your 401k or IRA. Many of our clients believe Gold is a long term hedge against inflation and wish to add it to their retirement portfolio. Reply from New Silver.

Discipline

Take this into consideration. Gold is an age old investment form that has been used for decorative and ornamental purposes in prehistoric times. Examples of IRS approved depositories include Delaware Depository Service Company, JP Morgan Chase, HSBC, and CNT Depository. With a commitment to providing exceptional customer service, competitive prices, and a secure platform, Augusta Precious Metals has quickly become a trusted name in the industry. 8/5 rating from Google My Business. Experience the Benefits of Gold Alliance Join Today. Note that you cannot hold/store the gold yourself rather it has to be stored in a secure depository. Review step by step directions to complete a Precious Metals Purchase Kit HERE. This company is transparent about the fees you’ll need to pay to keep your gold IRA account active. American Hartford Gold Group also offers a range of educational resources to help customers understand the benefits of investing in a silver IRA. While many investors usually focus on more traditional investments such as bonds, stocks, and mutual funds, the tax code also allows people to invest in precious metals like platinum, silver, and gold using special IRA accounts. This includes recommendations for IRAs or leveraged purchases that come with expensive monthly fees for administration, handling, storage, or insurance; purchasing collectible coins with high markups and low liquidity; and tapping retirement savings, which is where many Americans hold the bulk of their investment assets. I was nervous about working with someone based on past experiences, but John was honest with me, informative, and he allowed me to ask the most minute questions, and he answered them where I could understand.

Excellence is an understatement

The value of gold is generally lower when the stock market is overperforming. They will help you fill out the necessary paperwork and facilitate the transfer of funds from your existing IRA or 401k to your new Gold IRA. Rosland Capital cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Discover the Luxury of Oxford Gold: Experience Quality, Style, and Comfort Today. These factors included BBB rating, Trustpilot rating, fees, educational resources, customer support, collection of precious metal coins and bars, and more. Click Here to Learn More About Lear Capital. The fees for buying and selling gold are not tax deductible. Silver rounds are an excellent way to secure your wealth and provide insurance for your money. Although a custodian is technically allowed to own or manage a depository, it is extremely rare. Here are the answers to frequently asked questions about gold and other precious metals in an IRA. Gold IRA allows you to cushion against inflation and economic uncertainty, provides tax advantages similar to other IRAs, and it is easier to store physical metals. And Canadian mints make 1 oz. Use this to help with the down payment and/or renovation costs. This is in addition to its earlier successes in both the residential and commercial markets, where it has aided entrepreneurs in the purchase, refurbishment, and then flipping of a number of properties.

Related Categories

- Exactly what E-Learning Networks?An e-learning platform permits students and learners to master new skills and topics with no need for physical… Continue reading Exactly what E-Learning Networks?

- What Is Software Creation?Software production is a subsection, subdivision, subgroup, subcategory, subclass of information technology that involves designing and building courses… Continue reading What Is Software Creation?

- Digital Data Area ProvidersVirtual data room providers offer platforms with regards to securely hosting, sharing and managing business documents. They can… Continue reading Digital Data Area Providers

- Best Make silver ira companies You Will Read in 2021Great Lakes and Nelnet: Part of the Same Family With a gold and silver IRA, investors can benefit… Continue reading Best Make silver ira companies You Will Read in 2021

- What Does Your Food Restaurant Website Need To Have?

Restaurant operators are becoming masters at generating creative business strategies, preparing exquisite cuisine, and providing unforgettable guest experiences.… Continue reading What Does Your Food Restaurant Website Need To Have?

Restaurant operators are becoming masters at generating creative business strategies, preparing exquisite cuisine, and providing unforgettable guest experiences.… Continue reading What Does Your Food Restaurant Website Need To Have?